How to Manage Emotional and Financial Stress After Retirement

Managing emotional and financial stress after retirement means building a stable routine, protecting your savings with a simple plan, and creating a new sense of purpose so you feel secure, useful, and connected. Start with three basics: track monthly spending, talk to one trusted person weekly, and pick one meaningful activity (learning, mentoring, part-time work, or volunteering). Counselling !

If you searched for How to Manage Emotional and Financial Stress After Retirement, you are not “overthinking”. Retirement is a big life transition, and transitions naturally create stress. career counselling in Bangalore

Key takeaways (quick, practical):

- Emotional stress reduces when you replace job structure with a simple weekly routine.

- Financial stress reduces when you create a realistic budget, emergency buffer, and spending rules.

- Purpose reduces both kinds of stress, especially when you mentor, consult, or learn.

- Professional support helps faster, through counselling for senior citizens and a clear encore-career plan.

Why does retirement feel stressful even if I planned financially?

Retirement changes more than income.

It changes your identity, daily structure, social circle, and sense of progress.

Even people with savings feel anxious because the “salary rhythm” ends and expenses (especially healthcare) can feel unpredictable.

A helpful mindset shift is this: retirement is not an ending, it is a career transition into a new life stage.

What causes emotional stress after retirement?

Emotional stress after retirement usually comes from a few core losses.

“Who am I if I’m not working?”

Work often gives status and self-worth.

When it stops, many retirees feel invisible or “not needed”.

“Why are my days blending into each other?”

Without meetings, deadlines, and colleagues, time can feel empty.

That emptiness often shows up as irritability, restlessness, or sadness.

“Why do I feel lonely even with family around?”

Family members may be busy.

And many friendships were work-based, so they fade without regular contact.

“Why am I worrying more about health?”

Health anxiety is common after retirement.

It becomes stronger when routines and social movement reduce.

If you feel persistently low, anxious, or hopeless, consider speaking with a qualified mental health professional. You can also explore ELYSIAN INSPIRES’ support resources like counselling for depression in Chennai.

How can I manage emotional stress after retirement day to day?

Think in three buckets: structure, connection, and meaning.

What “structure” should I create after retirement?

You do not need a strict timetable.

You need a repeatable weekly rhythm that makes your brain feel safe.

Try this simple template:

- 3 fixed anchors per week (morning walk, hobby class, religious/community visit)

- 2 social touchpoints (call an old colleague, meet a friend)

- 1 “progress” block (learning, mentoring, writing, or small business planning)

This reduces anxiety because your week stops feeling random.

How do I rebuild social connection without forcing myself?

Start small.

Aim for consistency over intensity.

Good options:

- Join one local group (library, temple committee, residents association)

- Volunteer 2 hours a week

- Mentor one student or young professional

If social confidence feels low, online counselling for career guidance can also help you create a gentle plan that fits your personality and energy.

What does “meaning” look like after retirement?

Meaning comes from using your strengths in a way that benefits others.

For many seniors, meaning returns when they:

- Teach what they know

- Support their family without over-controlling

- Build a small income stream for independence

This is where counselling for senior citizens becomes powerful, it helps you translate experience into a realistic next chapter.

When should I seek professional support for emotional stress after retirement?

Seek support if symptoms are frequent, worsening, or affecting daily life.

Common red flags:

- Sleep issues most nights

- Loss of interest in everything for 2+ weeks

- Frequent anger, panic, or crying

- Withdrawal from family and friends

- Using alcohol or food to numb feelings

Support can be emotional (therapy) and practical (career and life planning).

At ELYSIAN INSPIRES, many clients prefer a combined approach: life transition clarity plus next-step planning through counselling for senior citizens.

What causes financial stress after retirement in India?

Financial stress after retirement usually comes from uncertainty.

“What if my medical costs increase?”

Healthcare inflation is real.

Even with insurance, out-of-pocket costs can rise.

“What if I outlive my savings?”

Longevity risk is one of the biggest fears.

You do not need to predict the future, you need a plan with buffers.

“What if my children need support?”

Many Indian retirees still support adult children.

This is emotionally meaningful, but financially risky without boundaries.

“What if I get scammed?”

Frauds often target retirees.

For safety, rely on official sources for rules and updates, like RBI’s consumer education and SEBI’s investor awareness.

How do I create a simple retirement budget that reduces stress?

A retirement budget should be easy enough to follow even on tired days.

Start with a 30-minute “money snapshot”:

- List guaranteed income (pension, rent, interest)

- List essential monthly expenses

- Identify 1 to 2 “leak” categories (online shopping, frequent dining)

Then create three spending buckets.

| Bucket | What goes in | Why it reduces stress |

|---|---|---|

| Essentials | groceries, utilities, medicines, basic transport | protects daily stability |

| Lifestyle | travel, gifts, eating out, hobbies | prevents resentment and burnout |

| Buffers | emergency fund, health buffer, home repairs | absorbs shocks so you don’t panic |

If you want extra peace of mind, keep a written rule like: “Large expenses are discussed after 24 hours.”

That single pause prevents impulse spending and regret.

Is it better to cut expenses or increase income after retirement?

It depends on your health, responsibilities, and temperament.

Here is a simple comparison.

| Approach | Pros | Cons | Best for |

|---|---|---|---|

| Cutting expenses | immediate relief, low effort | can feel restrictive | fixed-income retirees with stable lifestyle |

| Increasing income | restores autonomy, reduces fear | requires energy and learning | retirees who want purpose and flexibility |

For many people, the best answer is a blend: reduce leaks and add a small income stream.

This is also a common outcome of online counselling for career guidance, because a counsellor can help you choose a low-stress income option that matches your strengths.

Should I work after retirement, or will it increase stress?

Working after retirement can reduce stress if it is designed correctly.

The key is choosing the right format.

What are low-stress work options for retirees?

Options that often work well:

- Consulting in your previous domain (2 to 8 hours/week)

- Tutoring or coaching (online or local)

- Remote support roles (documentation, project coordination)

- Small business with limited hours

For ideas, you can also read: How can retired people use their experience to work from home?

Pros and cons of working after retirement

Pros:

- Extra income, reduced fear

- Social contact

- Identity and routine

Cons:

- Can become stressful if you overcommit

- Family may misunderstand your boundaries

- Tech learning curve can frustrate some seniors

A counsellor can help you pick a “right-sized” plan so work supports life, not replaces it.

This is exactly what counselling for senior citizens is meant to do.

How can career counselling help after retirement?

Career counselling after retirement is not about competing with 25-year-olds.

It is about building an “encore role” that fits your health, values, and financial needs.

With ELYSIAN INSPIRES, seniors often want help with:

- Identifying skills they can still monetize

- Exploring second careers and meaningful roles

- Profile building and CV updates

- Confidence and decision-making support

If you are looking for career counselling in Chennai, you can start with the dedicated seniors page: Career counselling for senior citizens in Chennai.

If you are based outside Tamil Nadu, support is still possible through online counselling for career guidance, especially when mobility or privacy is important.

What is the difference between a financial advisor, a therapist, and a career counsellor for retirees?

Many retirees need more than one type of support.

Here is a simple way to choose.

| Professional | Helps mainly with | When it’s most useful |

|---|---|---|

| Financial advisor | investments, cash flow strategy, risk | when you need a portfolio plan |

| Therapist/psychologist | anxiety, depression, relationships | when emotions affect daily functioning |

| Career counsellor | purpose, skills, work options, transition plan | when you want a new role and routine |

If you feel stuck between “I should relax” and “I should earn”, a career counsellor can help you design a middle path.

That is why many families choose counselling for senior citizens as a practical and emotional reset.

What does a realistic example plan look like?

Here is a simple example.

Example: Mr. Ravi, 61, retired bank employee

Ravi felt anxious because he stopped receiving a salary.

He also felt emotionally low because his social circle reduced.

A low-stress plan could look like:

- Financial: fixed monthly budget + separate health buffer

- Emotional: morning walk group + weekly call with a friend

- Purpose: 6 hours/week tutoring commerce students

Within 6 to 8 weeks, stress often reduces because “uncertainty” becomes “routine + plan”.

If you want structured guidance, ELYSIAN INSPIRES offers career counselling in Chennai and online counselling for career guidance to help create this kind of personalized plan.

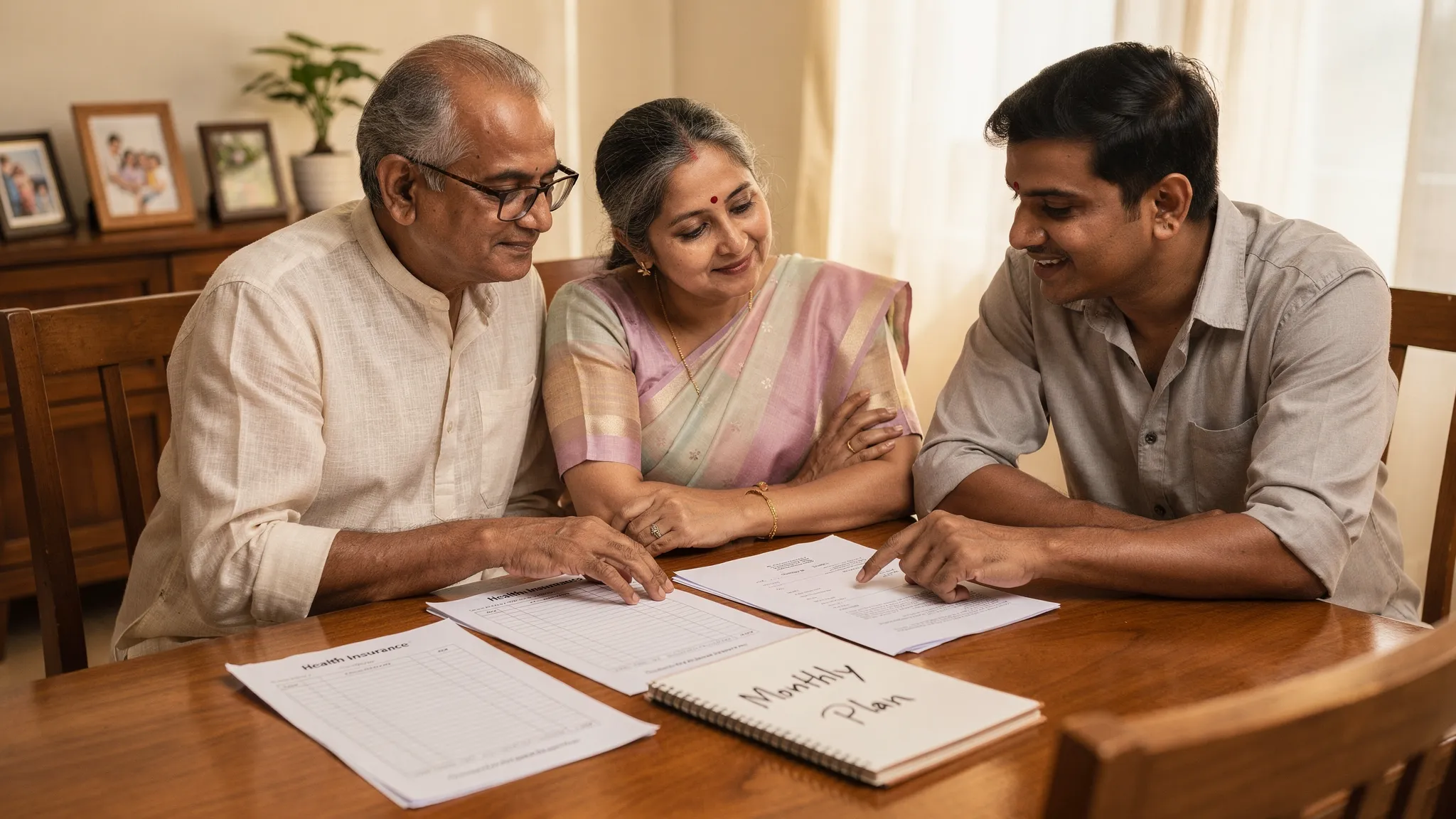

What can family members do to reduce a retiree’s emotional and financial stress?

Families help best when they provide respect plus clarity.

Try these:

- Ask, “What do you want your week to look like?” instead of “Relax now.”

- Involve seniors in household decisions, without burdening them.

- Agree on money boundaries (support for children, gifts, travel).

- Encourage one outside activity per week.

If family conflict is part of the stress, family counselling in Chennai can help improve communication.

What is a 30-day plan to feel emotionally and financially stable after retirement?

This plan is simple on purpose.

Week 1: Stabilise

- Track spending daily (just notes, no judgement)

- Fix wake time and sleep time

- Walk 20 minutes a day

Week 2: Reduce uncertainty

- Create your three-bucket budget (Essentials, Lifestyle, Buffers)

- Review insurance and key documents

- Choose one social activity to repeat weekly

Week 3: Create purpose

- List 10 strengths you used in your career

- Pick one role: mentor, tutor, consult, volunteer

- Draft a one-page profile (experience + what you offer)

Week 4: Get support and iterate

- Speak to a counsellor for a clear plan and accountability

- Adjust budget leaks and time commitments

- Set a 90-day goal (not a lifetime goal)

This is where online counselling for career guidance helps, it makes the plan personal, not generic.

How do I choose career counselling support in Chennai or Bangalore for retirement planning?

Choose based on fit, ethics, and clarity.

If you prefer in-person support, career counselling in Chennai can be ideal for retirees who want structured sessions and follow-ups.

If you are in Karnataka, you can explore career counselling in banglore through ELYSIAN INSPIRES’ Bangalore support page: Career counselling in Bangalore.

If you want comfort and convenience, choose online counselling for career guidance so you can attend from home.

To start quickly, you can use the online career counselor contact number and ask what format suits your situation.

Talk to ELYSIAN INSPIRES for a calm, practical retirement transition

If retirement is feeling emotionally heavy, financially confusing, or both, you do not have to solve it alone. ELYSIAN INSPIRES offers counselling for senior citizens to help you build a clear routine, a realistic income or engagement plan, and a sense of direction.

Explore: Career counselling for senior citizens in Chennai or call via the online career counselor contact number to book a session (in-person or online).

Frequently Asked Questions

How to manage emotional and financial stress after retirement in a simple way?

Is counselling for senior citizens useful even if I am not looking for a job?

What is the best option if I live outside Chennai or have mobility issues?

Can career counselling in Chennai help with post-retirement profile building?

Do you offer support for retirees based in Karnataka?